This page provides an overview of everything you need to know about your property taxes in the Town of Bradford West Gwillimbury.

2024 Calendar

Property Taxes are issued twice annually:

| 2024 TAX YEAR | All Properties |

|---|---|

|

Mailing date: |

February 1, 2024 |

|

Interim 1st instalment: |

Due February 27, 2024 |

|

Interim 2nd instalment: |

Due April 26, 2024 |

|

Mailing date: |

June 1, 2024 |

|

Final 1st instalment: |

Due June 26, 2024 |

|

Final 2nd instalment: |

Due September 26, 2024 |

If you are a property owner within the Town of BWG you can view account information for your property taxes and water/wastewater utility accounts by visiting Virtual Town Hall.

Tax Rates

Frequently Asked Questions

|

Can my tax bill be emailed to me? |

|

Yes! The Town of Bradford West Gwillimbury offers e-billing for property tax bills! Send an email to finservices@townofbwg.com. You must use an email address that contains the full name of one of the property owners.

In the body of your message, be sure to include your roll number, property address and the email address you would like to receive your bills to.

You can also switch your water and wastewater utility bills to e-bills using the same process!

Please be aware that you can only receive either an e-bill or a paper bill, but not both. |

|

How is my tax bill calculated? |

|

Tax bills are calculated by taking the assessment value provided by the Municipal Property Assessment Corporation (MPAC) and multiplying it by the current tax rate.

The tax rate is determined every spring, and is a combined rate set by the Town of BWG, the County of Simcoe, South Simcoe Police and the Provincial Ministry of Education.

Interim bills are based on no more than 50% of your annualized property taxes from the previous years. |

|

How does the Town of BWG determine tax rates? |

|

The tax rate is calculated based on the total amount of taxes required to provide goods and services to the Town of BWG using the total assessment provided by MPAC.

The County and Education property tax rates are calculated in the same way using the amount of taxes required for them respectively.

For a detailed explanation of the calculations involved, watch this video from MPAC: |

|

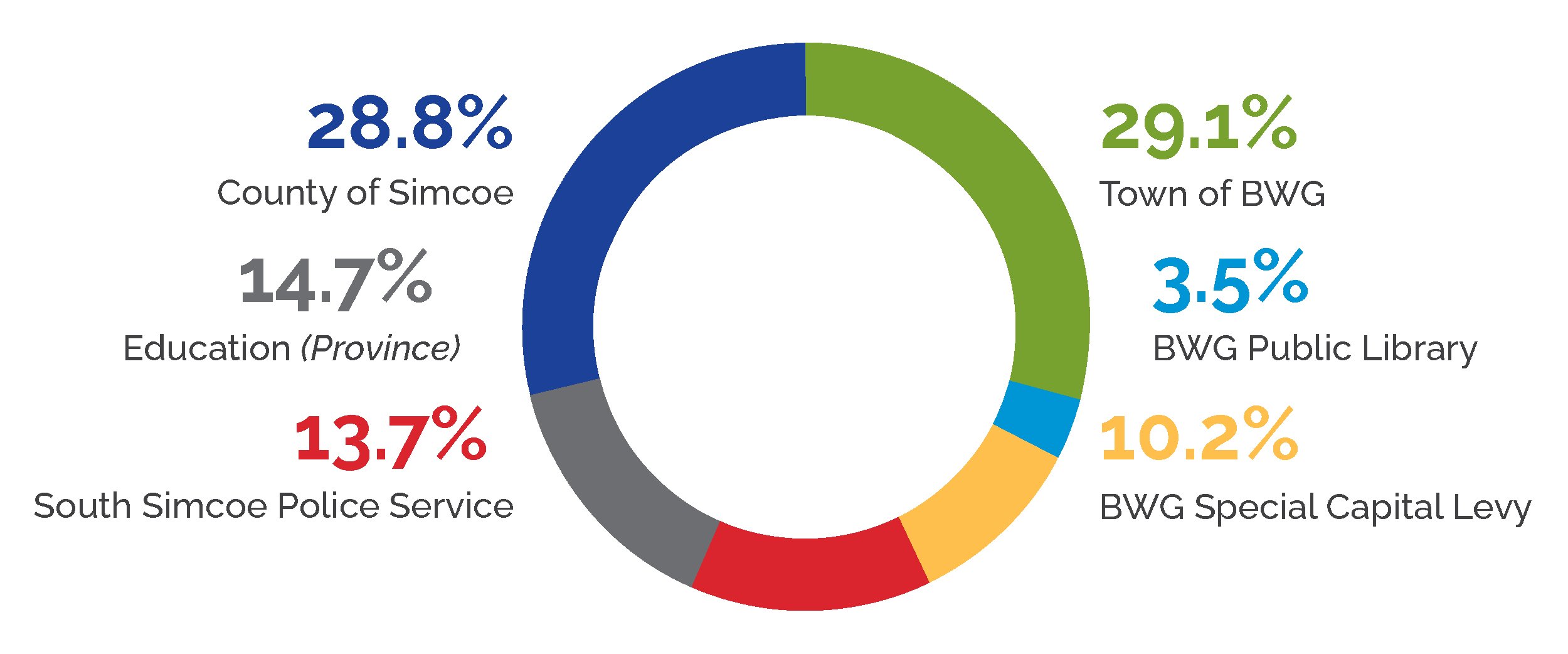

Where does my tax money go? |

Town of Bradford West Gwillimbury Council passed the 2024 budget during their January 16th meeting, reflecting a 4.24% total increase paid via annual property taxes. For more details about Budget 2024 please visit our Budget and Finance page.Please note: Increases are not reflected on the interim tax bill issued on February 1st but will be reflected on the final tax bill issued on June 3, 2024.

|

|

How do I change my school support? |

|

There are four different school support options within Bradford West Gwillimbury: English Public, English Catholic Separate, French Public or French Catholic Separate.

Your school support shows on your interim and final tax bills under "Assessment – Class/Educ. Support". To support either the English or French Catholic Separate school board, the owner or tenant must be Roman Catholic. School support for the current tax year is reflected on the final tax bill.

If you wish to change your school support you must contact MPAC to receive the proper form to fill out. Visit their website for more information. |

|

Can I appeal my property taxes? |

|

You can appeal your property taxes for reasons outlined in Sections 357 and 358 of the Municipal Act. Some of the reasons that fall under these sections are: property assessment class change, demolition of a structure or razed by fire. The last day to file your appeal is February 28 of the year following the change. Learn more from MPAC.

In order to appeal you must submit this form to the Town of BWG outlining the reason, the date it occurred and a brief explanation. Any supporting documentation to help explain your appeal can be attached to the application and emailed or mailed to us.

The Town of BWG will send all further official correspondence through Canada Post mail to the mailing address on file.

|

Contact Us